Nigeria economy is under performing and the quarterly indicators bear the fact that the economy is floundering and has finally lost its anemic momentum. The rising inflation rate is quite alarming as the numbers from the country’s National Bureau of Statistics detailed that inflationary rate spiked to 16.82% in April from 15.92% in March of this year.

“Food-price inflation rose to 18.37% in April from 17.20% in the previous month, reflecting increases in the prices of bread and cereals, potatoes, yam and other tubers, wine, fish meat and oils, the NBS said. Economists said inflation is rising in the West African country due to higher electricity prices and increased costs to transport goods and services. The fuel scarcity in February resulted in sharp rises in the cost of gasoline and diesel, they said.”

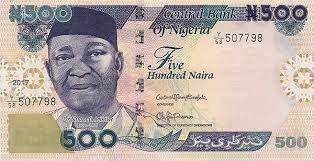

“Diesel used by heavy trucks to transport farm produce and manufactured produce is currently selling at 640 to 650 Nigerian naira ($1.54-$1.57) per liter, up from NGN300 per liter seven months ago, resulting in manufacturers and service providers passing the higher cost to consumers. The price of gasoline rose to NGN300 to NGN4 00 per liter in February during the fuel scarcity, but is no longer in short supply. It is currently selling at the government prescribed pump price of NGN165 per liter.”

According to Nigeria’s Debt Management Office the country utilized 86% of her generated revenue in servicing its crushing debt. The total debt of Nigeria at December of 2021 stood at $94.166bn. Nigeria is barely left with reasonable revenue after debt servicing. And this is the reason that Nigeria resorted to borrowing to finance her annual budget of $39.8 Billion of the year 2022..

The compelling “major reason for Nigeria’s high debt service-to-revenue is its low revenue generation. Analysts are worried that Nigeria is not raising enough revenue from an economic size of over $400 billion, wondering why policy makers are not thinking out of the box.”

Thinking outside box is recommendable. Intrinsically, the country must find a means to generate bigger and more revenue that it badly needed to run the country.. The government cannot function with 14% revenue that remained after servicing of the national debt. But taxing businesses and citizens must not be the option. The business entities especially the small business has been overburden with taxes and levies. In addition, the cost of energy is crushing local producers. Since electricity is not functional, the producers are using diesel which is also very expensive for their generators .

Nigeria erratic monetary and fiscal policies are not pro-growth. The high taxes from federal, state and local governments are not properly synchronized and streamline to promote growth while the incentives for economic growth are absent which makes growth virtually impossible.. The high inflation rate coupled with average maximum lending rate of 30.73 per cent discourage borrowing for expanding and starting business. Therefore it make sense to abandon producing goods locally in favor of importation because of high cost of production in the country. Then together with instability and lack of protection of lives and property the economy looks to be permanently depressed.

Leave a Reply